Outsourced payroll function

Our team of accountants can assist you with the payroll needs of your business. Continuous changes in legislation as well as changes to the terms of employment of your employees may be very time consuming. By outsourcing your payroll function, you will be in a better position to focus on your core business areas as well as ensuring that all the applicable legislative requirements are being met by your company on a timely and cost-effective manner.

Our payroll services include the following aspects which are applicable both to companies and self-employed persons who employ individuals:

Preparation of monthly payslips;

Calculation of tax to be withheld under the Final Settlement System (FSS) and National Insurance Contributions;

Preparation of encrypted files to be uploaded through internet banking;

Calculation of statutory bonus and other applicable deductions;

Monthly electronic submission of FS5 forms;

Preparation and filing of annual FS7 forms; and

Preparation of FS3 forms

Personal tax rates:

In accordance with the Final Settlement System (FSS) Rules, every person shall register with the Commissioner within fifteen days from the date the first emoluments due to be paid by him to a payee start to accrue.

Every payer shall deduct tax from each payment of emoluments made to a payee, to the extent that it consists of or includes a payment in cash by applying, as the case may be, one of the following tax deduction methods:

FSS Main Tax Deduction Method - applicable to all local pensions and any income from emoluments (excluding those payable in respect of part-time work and to which the part time rules are applicable);

FSS Part-Time Tax Deduction Method – applicable to emoluments payable to a payee in respect of part-time work which qualifies under the applicable respective conditions identified by the Income Tax Act and the Part-time Work Rules;

FSS Other Emoluments Tax Deduction Method – applicable to any other remuneration payable or fringe benefits that are provided to an individual for services rendered by him except where such individual receives payment in the course of his trade, business or profession or is otherwise required to be registered for VAT.

FSS Tax deductions

The tax deduction which is calculated in accordance with the FSS Main Cumulative Tax Deduction Formula is determined with reference to the progressive tax rates applicable to the payee.

The progressive tax rates applicable to Basis Year 2020 are as follows:

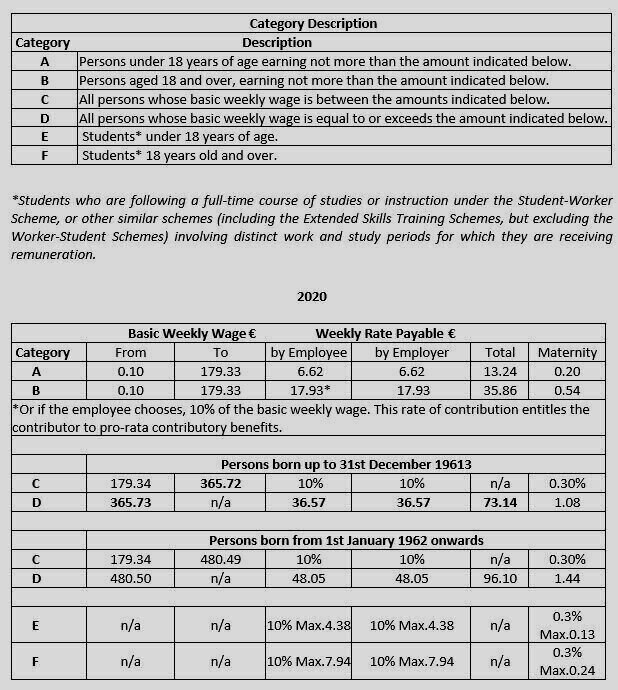

Social Security Contributions

All persons who are in an insurable employment and who are over the age of sixteen and who have not yet attained retirement age of sixty five years, are liable to pay Social Security Contributions in Malta.

Social Security contributions are calculated on the following rates (Class 1 rates);